tax per mile california

Forget the gas tax. The program is a voluntary option for drivers of eligible vehicles to pay their highway use fee on a per-mile basis.

Ca To Roll Out Pay Per Mile Pilot Program For Drivers Calwatchdog Com

Now California politicians are proposing a costly and unfair new Mileage Tax - charging you per mile that you drive.

. Instead it would be calculated on a per mile basis. Oregon and Utah launched similar pilot programs in 2015 and 2020 respectively. The new rate for.

Since 2015 the program allows the state to study a road. In Depth Recent News. A mileage tax would not be calculated on a per gallon basis.

SANDAG Mulls Per-Mile Tax for Drivers. The program is a voluntary option for drivers of eligible vehicles to pay their highway use fee on a per-mile basis. Commuting is a necessity in my district and a per-mile tax would be a huge blow to middle-class families Wilk said on Twitter.

Drivers in San Diego County could be charged a set price for each mile they drive under a controversial plan being. October 1 2021. Forget the gas tax.

Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business. The California Legislature has approved a bill to extend the states road charge pilot program. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a gasoline tax.

Replacing Californias gas tax. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. What is a mileage tax.

It is also a way for the state to collect taxes from motorists who are buying and driving electric vehicles. At a fee of 18 cents per mile driven. Request for Transcript of Tax Return Form W-4.

Your vote on state and local races in. The undersigned certify that as of June 18 2021 the. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that includes building out.

At a fee of 18 cents per mile driven which has been. I voted no on SB339 a bad bill pursuing a. Web Tax Per Mile California.

Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. You can think of it as a pay-per-mile tax that subsidizes government programs. Hence all vehicles will have to pay the same amount as mileage tax regardless.

Your vote on state and local races in. A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on. Mileage tax is a type of tax that is paid by the driver based on miles driven.

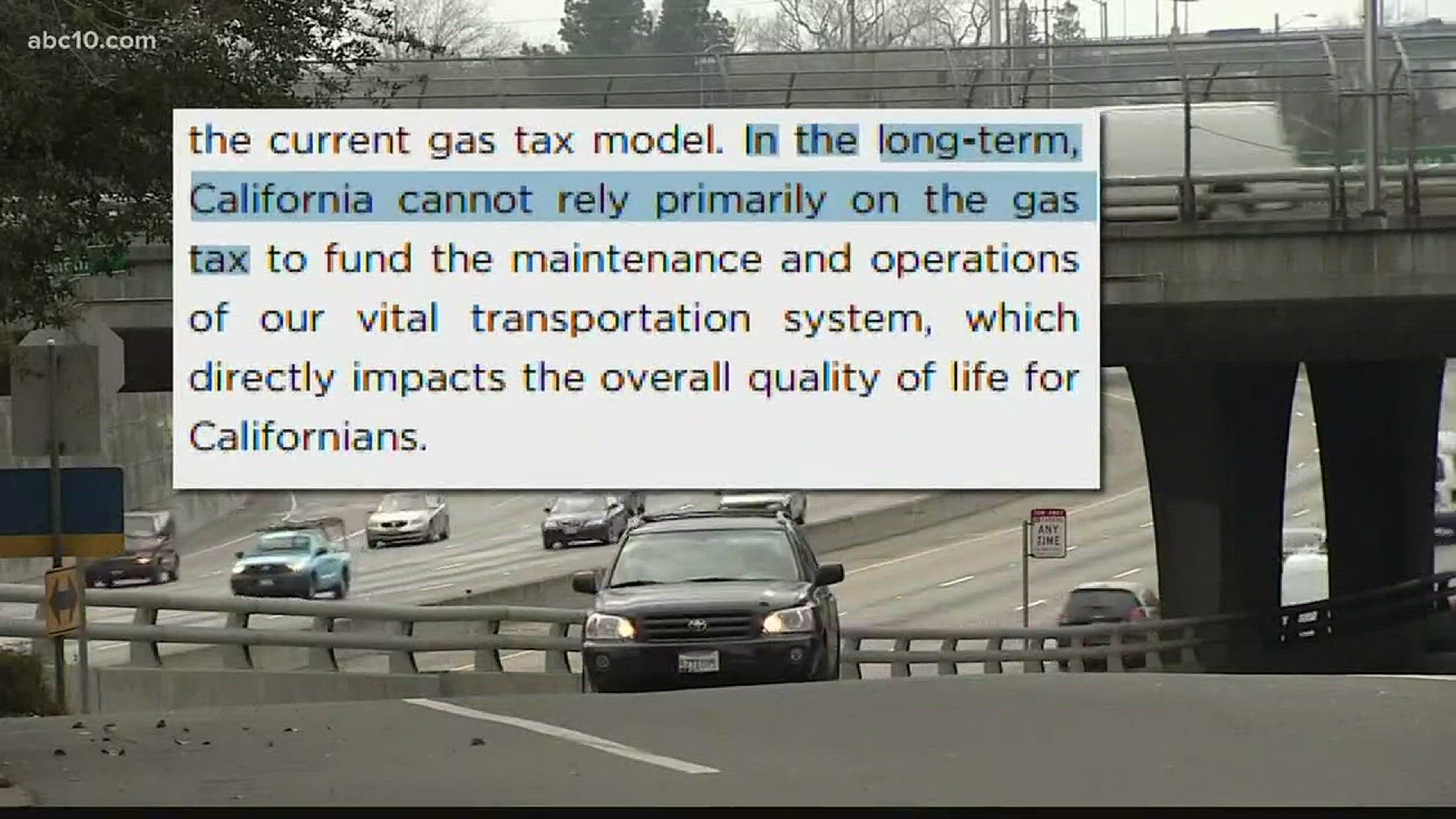

California Department of Tax and Fee Administration. A recent article in The New American reported that thanks to a gas tax increase that just went into effect on November 1 California residents are now paying 12 cents more per gallon of gas and. The average American drives thirty miles a day round trip to work and in California that average is significantly higher.

Since 2015 the program allows the state to study a road. Now California politicians are proposing a costly and unfair new Mileage Tax charging you per mile that you drive. Proponents argue that the state gasoline tax of 529 cents per gallon.

September 10 2021.

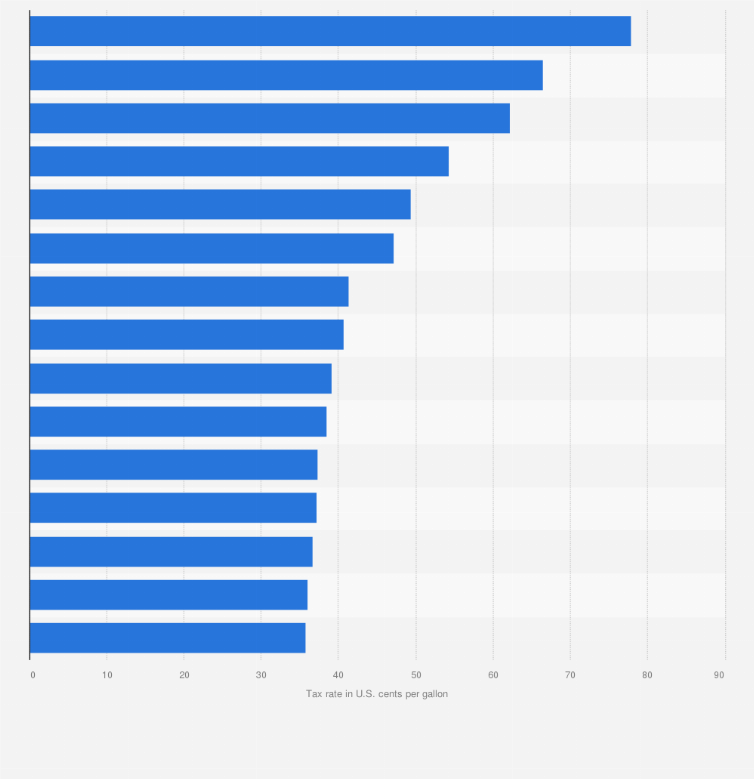

Gas Tax Rates By State 2021 State Gas Taxes Tax Foundation

Opinion Sandag S Proposed Per Mile Road Use Charge Is Misunderstood But It S Needed The San Diego Union Tribune

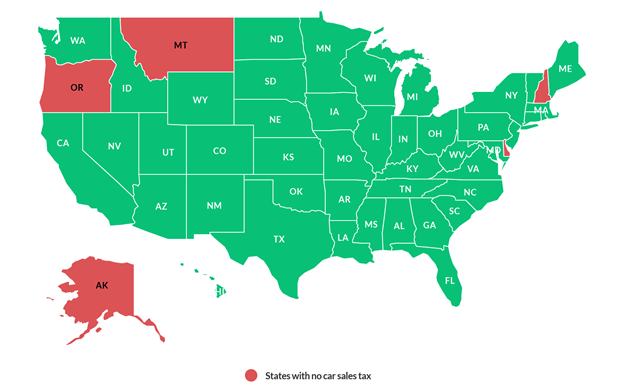

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Sandag Board To Consider Per Mile Road Usage Tax To Fund Transit Projects The Coast News Group

The Future Of Transportation Funding Gas Tax Per Mile Fees And Other Inlandempire Us

California Considering Plan To Replace Gas Tax With Charge Per Mile Driven East Bay Times

Why High Gas Prices Aren T Necessarily Good For The Climate Grist

Gasoline Taxes By State The Big Picture

If California Suspended Its Gas Tax What Would Happen

Highest Gas Tax In The U S By State 2022 Statista

California Tests Mileage Fee Plan As Answer To Dwindling Gas Tax

Should Electric Vehicle Drivers Pay A Mileage Tax Environmental And Energy Policy And The Economy Vol 1

Sandag Board Discusses Future Per Mile Road Usage Tax The Coast News Group

Could California Tax Drivers Per Mile Abc10 Com

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Claim Miles California Prop 22 30 Cent Reimbursement Entrecourier

Is Buying A Car Tax Deductible Lendingtree

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts